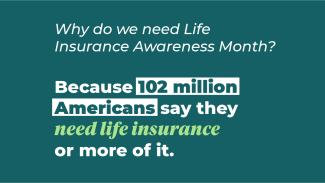

September is Life Insurance Awareness Month!

This September, we'll be exploring the different roles life insurance plays in financial planning at every stage of life. Whether you're just starting to think about coverage or exploring advanced strategies, there's something for everyone.

💡 Week 1: Getting the Basics Right

We'll start with the essentials—how to determine the right amount of coverage and the latest innovations in life insurance, such as "living benefits" and convertibility options. Surprisingly, 72% of Americans overestimate the true cost of a basic term life insurance policy, with younger Americans often thinking it’s three times more expensive than it actually is. We'll share some interesting stats and tips on attaining coverage that aligns with your client's financial goals.

🏥 Week 2: Exploring "Living Benefits"

Life insurance isn't just about what happens after you're gone. We'll explore how modern policies can provide additional benefits during your lifetime for the costs associate with long-term care. Did you know that about 70% of adults age 65+ will require some form of long-term care services in their lifetime? We'll discuss why planning for these costs is essential and the options available to ensure you're clients are covered.

🏢 Week 3: Protecting Businesses

For business owners, life insurance is more than personal protection—it’s key to ensuring their business thrives. We’ll discuss the importance of buy-sell agreements, protecting key employees, and how the Supreme Court case Connelly v. United States highlights the need for regular reviews.

🌳 Week 4: High-Level Planning

As we wrap up the month, we’ll focus on advanced strategies using life insurance for estate planning and retirement income. With the reversion of the Tax Cuts and Jobs Act approaching, we’ll explore how life insurance can help mitigate estate tax burdens and "disinherit the IRS." Additionally, we’ll dive into the benefits of a Protected Retirement Income Account (PRIA), which offers guaranteed income in retirement while safeguarding against market volatility.

Whether you're looking to protect your client's family, business, or legacy, now is the time to get informed and take action!